Buy-side participants in the FX market are increasingly focusing on the performance of FX trading and the need to improve it. This ongoing trend will manifest itself in a variety of ways,...

Investors have clear priorities for active equity portfolios: produce alpha and long-term appreciation. Historical data shows that innovative companies, which may be defined as those companies...

FICC revenues declined by (39)% on a YoY basis due to normalization across products. Equities 1Q21 revenue trends continued into 2Q21, wherein the overall revenues grew 26% YoY mainly driven by...

The COVID-19 crisis dramatically accelerated the adoption of digital tools and channels among executives. This report examines the implications of that acceleration, including the potential for...

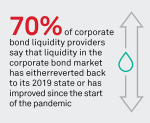

The technology innovation of the past decade has improved corporate bond liquidity. It’s hard to remember that not long ago corporate-bond market-structure chatter was all about the “...

Securities Services global revenues, which include custody and other fund services, remained flat in the first half of 2021, despite equity markets reaching a historical high.

The top banks...

With the recent swell in retail investor trading in both equities and equity options, it is important to pay attention to the perennial proposals to make changes to the tax treatment for...

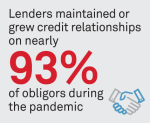

Despite Growth Headwinds, Lender Relationships Hold Firm

Data from our recently completed study of bank commercial credit executives shows that:

Lenders maintained or grew credit...

As asset owners around the world commit to aligning their investment objectives to the UN’s Principles for Responsible Investment, institutions face the complex task of putting that code into...

U.S. community banks have an opportunity to capitalize on their impressive performance during the COVID-19 crisis by capturing business from small businesses and middle market companies...