As electronic equities trading continues to grow, a significant proportion of U.S. low-touch desks are planning to expand their teams over the next 12–18 months.

Our outreach to 32 low-touch...

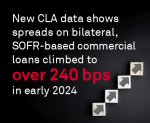

New and conflicting data on commercial loans could add to uncertainty as financial markets await some clarity from the U.S. Federal Reserve about interest rates.

Existing debt coming due in 2025 coupled with geopolitical concerns and other factors are driving corporate borrowers to tap the new issue market in record numbers. The first quarter of 2024 was...

In the dynamic landscape of institutional equity trading, asset managers face an ever-expanding array of choices, challenges and opportunities. Central to their success is selecting the right...

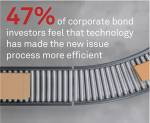

The U.S. corporate bond market has gone electronic over the past decade and now is moving onto phase 2—automation. Led by the largest global dealers and nonbank market makers, an increasing...

The expansion of investment and trading into global strategies, new products and electronically traded markets has tasked risk managers to enhance their risk monitoring capabilities. End-of-day...

Global markets trading revenue of the Coalition Greenwich Index Banks declined 6% in 2023 (FY23) compared to the previous year. This decline was driven largely by drops in equity derivatives,...

The prevalence of macro and geopolitical disruptions—changing interest rates, armed conflicts and potential recessions—continues to drive volatility, the need to hedge, and opportunities to...

Fixed-income traders are excited by core execution management system (EMS) functionality and are keen to adopt more advanced trading techniques. A very small percentage of fixed-income investors...

It’s a buyer’s market for corporate banking services in the Middle East. Attracted by economic momentum and a bullish outlook, global banks are targeting the Middle East as a key region for...