European banks are feeling the impact of regulations, finding it difficult to compete in fixed income with capital-constrained balance sheets. As a result, better-capitalized U.S. banks — and...

Greenwich Associates conducted its first U.S. Fixed-Income ExchangeTraded Fund Study to better understand how institutional investors use ETFs in their fixed-income portfolios. The study findings...

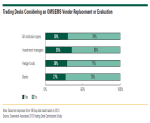

Over the next year, 30% of buy-side institutions will actively explore replacing or supplementing the technology that services their trading desks.

Several factors are driving the desire to...

FX swaps and forwards received exemptions from trading and clearing requirements imposed on derivatives in other asset classes. However, they will still feel the impact of trade reporting...

Given the head-spinning amount of market structure changes made in 2013, one might think the pace of change will slow in 2014: Greenwich Associates does not see this to be the case. In no particular...

An analysis of current industry and user trends, including:

The expected elevated amount of vendor evaluations by buy-side institutions in the coming year.

Budget changes...

Investment management firms see international expansion as an important pathway to future growth. Due to the demands and complexities associated with any cross-border venture, however, asset managers...

Recognizing the importance of RIA ETF deployment in driving institutional ETF usage trends, Greenwich Associates interviewed RIAs for the first time in 2013 to gain a better understanding of how they...

Every year Greenwich Associates brings together senior executives from a diverse group of leading asset management organizations to participate in a day-long roundtable discussion focusing on the...