Securities Services Index Revenues increased moderately in FY23 driven by higher Net Interest Income and growth in Asset under Custody/Administration. These were partially offset by decline in Fees...

New

Transaction Banking Revenues grew significantly in FY23 driven by strong growth in Cash Management offset by marginal decline in Trade Finance wherein 2H underperformed 1H.

New

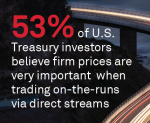

The majority of the U.S. Treasury market is traded electronically. In 2023, 64% of the $755 billion average daily notional volume (ADNV) was executed via a combination of central limit order...

New

Bank Account Management (BAM) consists of the policies, procedures and actions corporates follow to open, close or modify bank accounts held by their financial institutions. To assist with the...

New

Executive Summary – FY23 Coalition Index Investment Banking revenues fell (6)% YoY

FICC: Normalization in Macro products revenue from a highly volatile prior year period, especially in...

New

Known as the Basel III endgame, U.S. banking regulators in July 2023 proposed a set of amendments to capital rules governing financial institutions with >$100 billion in assets. With the...

New

Institutional investors in Europe are transforming their investment processes and portfolios by further integrating sustainability, expanding allocations to private markets and looking forward to...

New

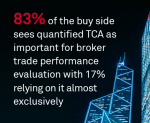

Transaction cost analysis (TCA) stands at the cornerstone of institutional equity trading, a quantitative tool to evaluate the impact of various execution decisions on both implicit and explicit...

New

Institutional investors are increasing their proportion of spending on Japanese equity research in the face of a long-awaited surge in Japanese stocks. That’s welcome news for Japanese brokers...

New

Over the past three years, leveraged loan markets have been on the same roller coaster as the rest of the fixed-income market. The mostly floating rate market was a port in the storm as interest...