2013 United States Institutional Investors Investor Situation and Needs

Over 60% of corporate pension funds have closed the primary plan to new employees in an effort to reduce future liabilities.

Over 60% of corporate pension funds have closed the primary plan to new employees in an effort to reduce future liabilities.

Shifts to specialty products are driving average fixed income fee levels upwards for the second consecutive year.

The majority of investors continue to prefer structuring portfolios by traditional asset classes vs. a risk bucket approach.

Trading volume in Interest Rate Derivatievs products increased across the Americas in 2013.

Trading volume in Foreign Exchange products increased across the globe in 2013.

Trading volume in Interest Rate Derivatievs products increased across Asia ex. JANZ in 2013.

Trading volume in Interest Rate Derivatievs products increased across the globe in 2013.

Trading volume in Interest Rate Derivatievs products increased across Asia in 2013.

Trading volume in Interest Rate Derivatievs products increased across Continental Europe in 2013.

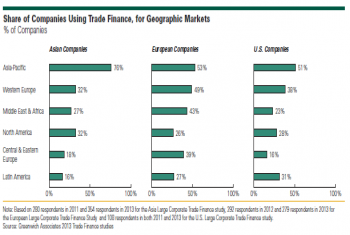

HSBC, Deutsche Bank and BNP Paribas are the leading providers in European corporate trade finance — a traditionally stable business that is now showing signs of some change.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder