An effective corporate foreign exchange desk can help a company’s liquidity management, currency hedging and support other key objectives of a treasurer.

An effective corporate foreign exchange desk can help a company’s liquidity management, currency hedging and support other key objectives of a treasurer.

Corporates in India continue to be optimistic about growth as per the latest Coalition Greenwich Voice of Client – 2024 India Corporate Banking Study.

Interest-rate derivatives (IRD) dealers face a competitive market and a variety of challenges—regulatory mandates governing capital, competition for talent and the need to constantly invest in technology chief among them.

Digital capabilities are a key enabler of financial services for corporates around the world. In Asian transaction banking, digital platforms are emerging as a primary driver of both service delivery and bank revenue growth.

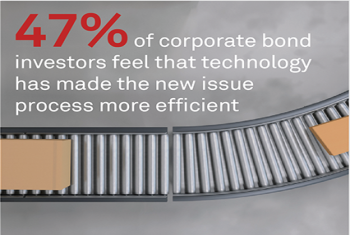

Global demand for fixed income assets has surged in recent years as yields have increased amidst efforts to dampen inflation in major markets globally.

In 1Q24 Coalition Index Investment Banking revenues were up 3% on a YoY basis.

Over 30 U.S. sell-side equity algo and market structure professionals share insights into their daily workflow, pain points, what they want their buy-side clients to understand.

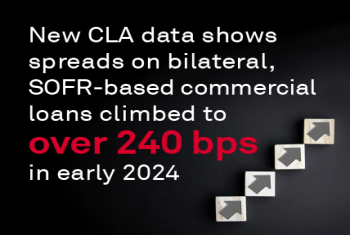

New and conflicting data on commercial loans could add to uncertainty as financial markets await some clarity from the U.S. Federal Reserve about interest rates.

Existing debt coming due in 2025 coupled with geopolitical concerns and other factors are driving corporate borrowers to tap the new issue market in record numbers.

Buy-side traders share key insights around selecting the right trading counterparties and fintech partners for their unique needs and workflows.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder