U.K. local authorities are pouring assets into alternative asset classes, with allocations to alternatives in institutional portfolios now at the same level as fixed income.

Press Releases

Coalition Greenwich Unveils Inaugural Greenwich Awards in Middle East Large Corporate Banking

May 7, 2024

Coalition Greenwich announces the winners of the first 2024 Greenwich Share and Quality Leaders in Middle East (UAE) Large Corporate Banking, alongside the recipients of the 2024 Greenwich Excellence Awards in several key categories.

In a Tough Funding Environment, U.S. Small Businesses and Midsize Companies Praise their Banks’ Credit Policies

April 23, 2024

Roughly half of U.S. small businesses and midsize companies say their banks’ support at a time of elevated interest-rates and borrowing costs has improved their satisfaction and deepened their loyalty to their current providers.

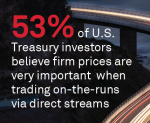

Streaming Prices Transforming U.S. Treasury Trading

April 23, 2024

Direct, continuous pricing streams are slowly but surely reshaping how U.S. Treasuries are traded.

Investment consultants have always been a critical part of the U.S. institutional asset management landscape, and new data from Coalition Greenwich shows the market’s top consultants are becoming more influential.

Welcome to the new U.S. institutional investment industry, in which private assets and artificial intelligence are transforming what has historically been a relatively placid and slow-to-change business.

Institutional investors in Europe are transforming their investment processes and portfolios by further integrating sustainability, expanding allocations to private markets and exploring artificial intelligence (AI).

Four Out of Five U.S. Companies Include Fintechs in Their Payments Services Provider Lineup

April 9, 2024

More than 80% of U.S. small businesses and midsize companies are utilizing a non-bank service provider to meet their payments needs.

U.S. banks are breathing a sigh of relief after regulators signaled plans to make major changes to a proposal to increase capital charges on large banks.

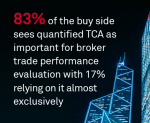

TCA: Minimizing Transaction Costs, Maximizing Returns

April 2, 2024

In an era in which every basis point counts for investors, embracing transaction cost analysis (TCA) is not just an option for institutional trading desks—it’s a strategic imperative.

Pages

Media Contacts

Media Inquiry

Awards

- Investment consulting: A relationship business in a transactional world

- 2025 Coalition Greenwich Leaders: Middle Market Banking in the U.S.

- 2025 Coalition Greenwich Leaders: Small Business Banking in the U.S.

- 2025 Coalition Greenwich Leaders: Global Corporate Banking, Cash Management and FX

- 2025 Coalition Greenwich Leaders: U.S. Corporate Banking, Cash Management and FX