Buy-side portfolio managers and traders are having trouble keeping up with the rapid transformation of front-office trading technology systems and need to be aware of the differences between solutions and how to best future-proof their businesses.

Press Releases

U.S. Companies and Banks Building New Digital Ecosystem for an Era of Real-Time Transactions

April 8, 2025

A push by large U.S. companies to closely link internal treasury systems to bank platforms is helping create a new digital corporate banking ecosystem tailored to an era of digital commerce and real-time payments.

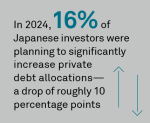

Japanese institutional investors are slowing their shift of portfolio allocations toward private assets.

The crypto market has entered a phase of rapid evolution and expansion, with invigorated institutional traders driving demand for more advanced trading strategies, platforms, and technology infrastructure.

Demand for commercial and industrial loans climbed steadily and sharply throughout 2024, driven by a combination of rate-cuts and improving economic sentiment. The question facing companies and banks today is: Can this momentum withstand simmering uncertainty about the business environment in 2025?

U.S. Institutional Portfolios: More Private Assets, Less ESG

March 25, 2025

U.S. institutional investors are making important changes to their portfolios by reducing their exposure to public equities, continuing to shift assets into private markets, and setting aside environmental, social and governance requirements.

Canadian Institutions Look to Brokers for Enhanced Liquidity in Small- and Mid-Cap Stocks

March 18, 2025

Canadian institutional investors are paying more attention to small and mid-cap stocks, and they are looking to their brokers for help accessing this market segment with enhanced liquidity and service.

A mix of political upheaval, geopolitical conflict and macroeconomic concerns is poised to fuel increases in derivatives trading activity.

By deepening ties with existing clients, corporate banks in Europe will optimize resource and balance-sheet deployment by driving higher yields from individual companies with which they already do business.

Middle Market Business Owners and Executives Ramping Up Expectations for Digital Banking Experience

February 26, 2025

Middle market U.S. companies are increasingly critical of their bank’s digital platforms, with declining satisfaction rates being driven by lower scores from a growing cohort of younger executives.

Pages

Media Contacts

Media Inquiry

Awards

- Investment consulting: A relationship business in a transactional world

- 2025 Coalition Greenwich Leaders: Middle Market Banking in the U.S.

- 2025 Coalition Greenwich Leaders: Small Business Banking in the U.S.

- 2025 Coalition Greenwich Leaders: Global Corporate Banking, Cash Management and FX

- 2025 Coalition Greenwich Leaders: U.S. Corporate Banking, Cash Management and FX