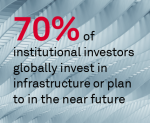

Increased Optimism for U.S. Commercial Lending in 2025

December 17, 2024

Borrowers’ outlooks on loan growth and lending volumes are much more positive compared to this time last year.