Foreign exchange trading is seeing market share concentration shift evermore in favor of the top 5 dealers, as FX trading volumes remain sluggish due in part to lack of volatility in the global...

Although ideally suited to electronic trading, the U.S. Treasury market saw a significant drop in e-trading volumes following the financial crisis.

Electronic trading in government bonds now...

While the U.S. corporate bond market continues to be dominated by the top dealers, Greenwich Associates data suggests that institutional investors are beginning to explore new liquidity providers in...

The increasing use of exchange-traded funds in fixed income is contributing to the uptake of ETFs by Canadian institutions as a standard tool for achieving strategic goals in their investment...

Greenwich Associates research shows that in 2014 the percentage of clients rewarding dealers for fixed-income research jumped by roughly 100% to more than half.

Fed by an onslaught of market...

Complex regulations in both interest-rate derivatives and U.S. Treasuries are constraining profits for brokers and creating new buy-side demands.

The top five’s share of both product sets...

U.K. institutional investors are taking advantage of a lack of bank lending in property by pouring capital into real estate debt. While most institutions stick to the safest real estate debt...

The growing importance of branding is reflective of the rapid evolution of the asset management industry in the post-crisis era. In the institutional market, investors’desire for advice and...

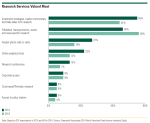

In a large, sophisticated sector such as institutional financial services, business allocation decisions are driven by a complex combination of quality factors. A broad measure like overall...

Understanding how new regulations impact all derivatives and securitized products, not just swaps, and how cleared and bilateral markets interact in the new world is crucial for investors.

The...