The events surrounding 2008 helped the concept of model risk management gain widespread acceptance as a key area of investment and attention. With the Fed’s SR 11-7 providing firms with few...

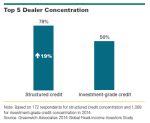

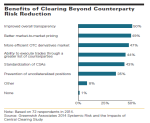

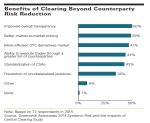

While central clearing has been successfully used in derivative markets for years, global swaps-clearing mandates are in the process of expanding adoption well beyond levels the market has ever seen...

Recent research by Greenwich Associates reveals that investors will increasingly look to futures as the most cost-efficient method of expressing their views on interest rates.

Regulatory impacts...

The shift from products to “solutions” is a central topic of conversation in the asset management industry. Despite the popularity of the term, there is a surprising lack of agreement...

European asset managers are at the forefront of a move by institutional investors to integrate exchange-traded funds (ETFs) into their investment portfolios.

Although other European institutions...

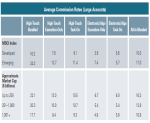

Greenwich Associates inaugural Comprehensive Commission Rate Study reveals that reported rates vary broadly among institutions trading in the same markets, not only in terms of bundled rates, but...

A recent study by Greenwich Associates of more than 350 buy-side traders finds that the marketplace is more interested in cross-product coverage than cross-asset-class technology platforms....

European institutional investors have adopted ETFs into their portfolios for a surprisingly diverse range of uses. Institutions are using ETFs to obtain the long-term strategic exposures they need in...

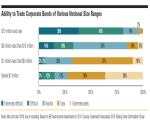

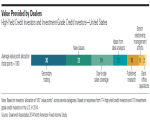

Trading corporate bonds is hard work, with block trades in particular remaining a major pain point for investors.

Greenwich Associates research shows that while traditional voice trading is here...

Despite the recent growth of electronic trading in corporate bonds, a trader is still in control of most trades.

The difficulties inherent in automating the art of bond trading explain why...