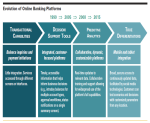

Based on its annual Online Services Benchmarking program, Greenwich Associates examines the eight characteristics that define "Best-of-Breed" online banking platforms.

Using data gathered through...

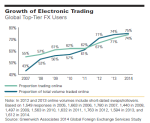

As clients will continue to need the global reach of the largest money-center banks, the top four FX dealers seem firmly entrenched.

Nevertheless, the market structure disruption that is upon us,...

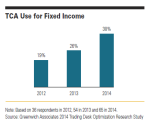

With both regulatory and economic factors feeding the trend, TCA is moving beyond equity and FX markets. Greenwich Associates research shows over one-third of fixed-income investors now use TCA as...

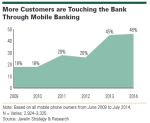

Digital banking platforms have joined the bank branch and the call center as core banking channels and must be viewed as equal in importance to the overall business going forward.

Banks and other...

The importance of social media in today’s world has not been missed by institutional investors. Interviews with over 250 asset owners found that 4 out of 5 institutional investors frequently use...

New

Against the backdrop of the European Central Bank kicking off its long-awaited government bond-buying program, a full 62% of the fund distributors participating in the Greenwich Associates 2014...

With technology innovation and regulatory complexity accelerating the pace of change, the level of competition among order and execution management system (OMS and EMS) providers remains...

Major market disruption has driven creation and expansion of industry utilities, many with technology that is newer and likely cheaper than the incumbents. Whether these attempts to gain market share...

For the past two years, small businesses and mid-sized companies have become increasingly positive about the status of their banking relationships. Qualified borrowers have seen widely available...

Greenwich Associates recent research finds that 35% of the total volume traded in the major fixed-income products in Europe was electronically executed in 2014, according to over 1,200 institutional...