More than half a trillion dollars of green bonds were issued in 20211, the highest level since the market was defined.

More than half a trillion dollars of green bonds were issued in 20211, the highest level since the market was defined.

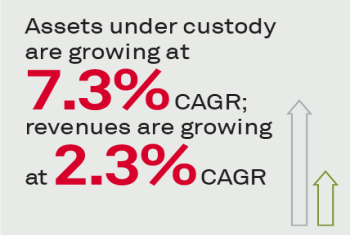

Securities services firms occupy a vital role in the smooth functioning of the capital markets industry. Mutual funds, ETFs and others rely on these providers to ensure that the operational processes so integral to the asset manager are smoothly run...

Credit markets are in a period of transformation, with inflation at a multi-decade high, interest rates rising and the post-pandemic economy still an unknown.

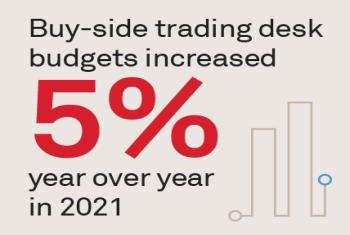

Industry-wide revenue pools increased 6% year over year in fiscal year 2021, albeit via different leading and lagging business lines from the year before.

The average buy-side trading desk budget is just over $2 million annually, inclusive of both technology and compensation.

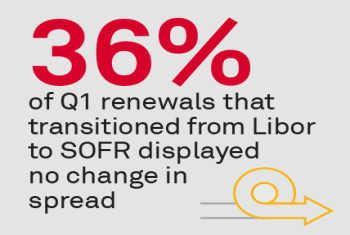

As Q2 2022 begins, most banks have moved away from originating new Libor-based loans.

ESG has entered the investment mainstream. A fringe concept in the global investment community less than 10 years ago, environmental, social and governance policies are now widely adopted by asset owners and managers alike.

The search for yield and an abundance of fast-growing startups have left even mass-market investors clamoring for the opportunity to invest in private companies.

Banks of all sizes have an opportunity to strengthen client relationships in Asia by helping companies adopt and implement ESG driven practices.

FY21 Coalition Index Investment Banking revenues were up by 8% on a YoY basis.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder