Bond Dealers Increasingly Automate Trading

June 12, 2024

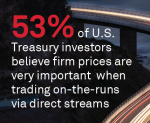

The corporate bond market is undergoing a seismic shift, with nearly 30% of bond dealer trading volume now executed without human intervention, marking a significant milestone in the electronification of fixed-income trading.