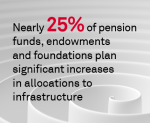

Welcome to the new U.S. institutional investment industry, in which private assets and artificial intelligence are transforming what has historically been a relatively placid and slow-to-change business.

Press Releases

Institutional investors in Europe are transforming their investment processes and portfolios by further integrating sustainability, expanding allocations to private markets and exploring artificial intelligence (AI).

Four Out of Five U.S. Companies Include Fintechs in Their Payments Services Provider Lineup

April 9, 2024

More than 80% of U.S. small businesses and midsize companies are utilizing a non-bank service provider to meet their payments needs.

U.S. banks are breathing a sigh of relief after regulators signaled plans to make major changes to a proposal to increase capital charges on large banks.

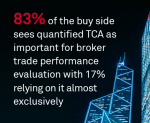

TCA: Minimizing Transaction Costs, Maximizing Returns

April 2, 2024

In an era in which every basis point counts for investors, embracing transaction cost analysis (TCA) is not just an option for institutional trading desks—it’s a strategic imperative.

Institutional investors are shifting their attention and trade commission payments back to Japanese equity research in the face of a long-awaited surge in Japanese stocks.

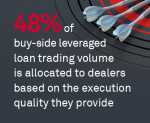

After a notable drop in leveraged loan revenue in 2022, dealers saw a rebound in 2023 with U.S. revenue topping $900 million. That total represents a 16% increase from 2021 and a 29% jump from 2022, according to a new study from Coalition Greenwich.

New data on bank lending shows just how tenuous the situation is for companies and the economy as a whole as the world waits to see whether the U.S. Federal Reserve will cut interest rates in 2024.

European corporates are consolidating their banking business with key relationships that provide superior service quality, robust digital platforms and comprehensive international networks.

Fewer Mandates, Shift to Private Assets Create Challenges for Japanese Asset Managers

March 19, 2024

Traditional asset managers could face an increasingly challenging marketplace in Japan as asset owners slow expectations for manager hiring and shift allocations in the direction of alternative and private assets.

Pages

Media Contacts

Media Inquiry

Awards

- Investment consulting: A relationship business in a transactional world

- 2025 Coalition Greenwich Leaders: Middle Market Banking in the U.S.

- 2025 Coalition Greenwich Leaders: Small Business Banking in the U.S.

- 2025 Coalition Greenwich Leaders: Global Corporate Banking, Cash Management and FX

- 2025 Coalition Greenwich Leaders: U.S. Corporate Banking, Cash Management and FX