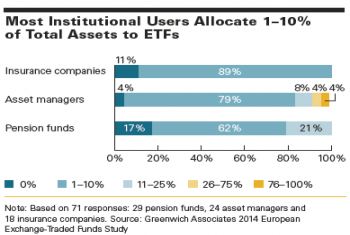

European asset managers are at the forefront of a move by institutional investors to integrate exchange-traded funds (ETFs) into their investment portfolios.

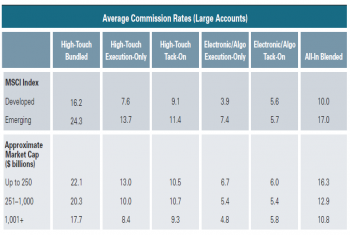

Equity Trade Commissions: Rates Vary Broadly Across and Within Markets

While commission rates on equity trades vary from country to country and from developed to emerging markets, new research reveals that commission rates vary from investor to investor within markets.

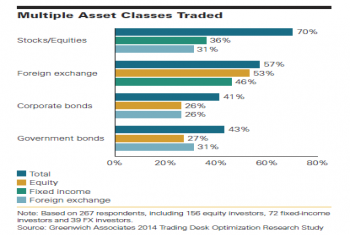

Cross-Product Capabilities Hold Key for Trading-System Providers

The concept of trading multiple asset classes through a single trading system is alluring, but traders' appetite for the systems shows a disconnect between the model and its practicality.

ETFs, a mainstay in European institutional equity portfolios, are quickly gaining traction in fixed income.

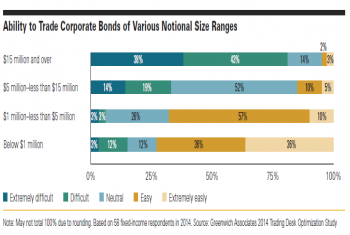

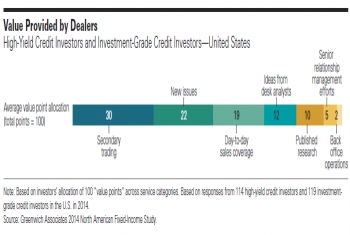

Relationships still matter when trading corporate bonds, but with dealers less willing and able to act as the market's shock absorber, the buy side is looking to new solutions.

Corporate Bond Best Execution: More Art Than Science

Since matching the buyer and seller for a bond trade remains principally in the realm of intuition and experience, defining "best execution" can be an elusive endeavor.

European Insurance Companies Find Many Uses for ETFs

European insurance companies are adopting ETFs for a wide range of functions across their investment operations

Portfolio Diversification Boosts ETF Use Among European Pension Funds

European pension funds are adopting ETFs into their investment portfolios for both strategic purposes, like obtaining core investment exposures, and tactical tasks.

On the heels of a year with a number of important market structure changes, Greenwich Associates presents the top 15 trends to watch for in 2015.

European Equities Under Attack From All Angles

The commission pool for European equities remains challenged while electronic trading continues to grow.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

GTR: Eric Li says short-term activity has been “quite positive as corporates have been...April 17, 2025

-

The Desk: Electronic trading makes up more than half of trading in US Treasuries, according to...April 17, 2025

-

Finance Magnets: Data from Crisil Coalition Greenwich indicates that on average, less than...April 16, 2025