What is Market Structure and Why Should You Care?

The term market structure is more than just financial jargon; understanding its definition is critical because it likely affects your business by providing either opportunities or headaches.

The term market structure is more than just financial jargon; understanding its definition is critical because it likely affects your business by providing either opportunities or headaches.

Identifying market trends and analyzing feedback from institutional investors, Greenwich Associates recommends four actions for asset managers to consider to best position themselves for success in an increasingly competitive environment.

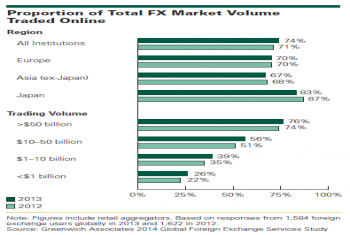

Almost three quarters of global foreign exchange trading volumes (74%) were executed through electronic systems last year, up from 71% in 2012.

The shift to central clearing should streamline trade processing over the long term, but industry collaboration is key.

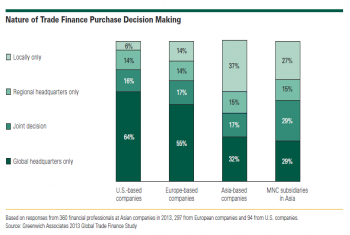

As increased capacity in Asia pushes trade finance pricing down in the region, regulations threaten to nudge it up.

Greenwich Associates research shows that an impressive 69% of study participants use their market data desktop solution’s mobile capabilities.

Better-capitalized U.S. dealers are picking up a growing share of fixed-income trading volumes in Europe.

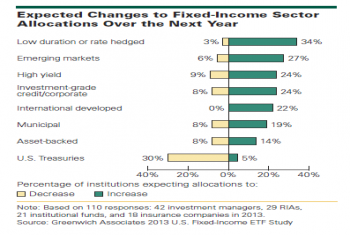

Fixed-income exchange-traded funds (ETFs) are poised to take on a bigger role in institutional portfolios.

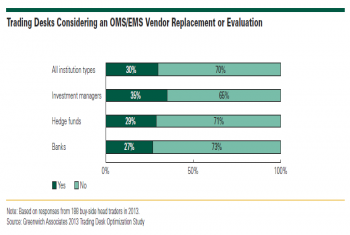

Thirty-nine percent of fixed-income desks reported a year-on-year budget increase and 30% are considering a change in the providers of their order management systems (OMS) or execution management systems (EMS).

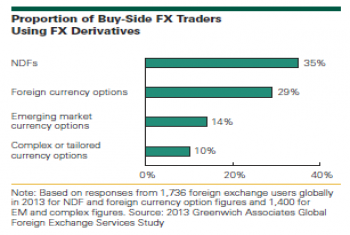

Regulatory-driven changes on the horizon will drive futures to become an important tool in foreign exchange traders’ toolbox.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder